Along with the rapid development of technology today, the demand for digital money is very high, where currencies can be accessed, helping everyone without a bank account in gaining access to funds and also allowing fast and cheap fund transfers without geographical restrictions.

The popularity of smart phones in developed countries and the speed of their expansion in developing countries allows companies like MyCryptoBank to offer complete banking platform services where we can use only smartphones and debit cards.

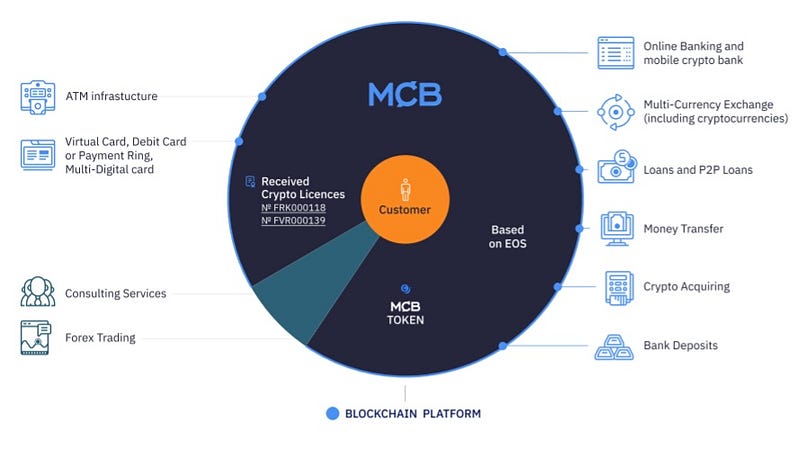

MyCryptoBank is an online bank that allows clients to be registered in electronic banks system for making various bank operations, additional operations with cryptocurrency (payment processing, debit cards, credit and cheap investment products, use cryptoassets as credit security and many others) based on Blockchain technology without department visits. So, MyCryptoBank provides remote client services access to bank accounts, products and services to conduct banking operations.

MyCryptoBank offers its clients a multifunctional banking service platform, which is a hybrid system that combines digital and traditional currencies. Use Digital currency makes operations faster and cheaper, while traditional currencies guarantee the acceptance and validity of all practical. One account combination allows clients to simultaneously use profits from both types of currencies.

Problems faced by MyCryptoBank

The micro community does not have permanent access to regular banking services, many of them who deal with crypto are even blocked by banks and institutions.

The main factor that made the bank industry stagnate

High cost

Long time waiting for transfers

Limited to the currency area that is a barrierMyCryptoBank solution

Making cryptobank loyal to the crypto community related to cryptocurrency services and blockchain technology.

How to overcome Industrial Problems by MyCryptoBank

Low cost

Fast transfer

There are no territorial restrictions

There is no currency limit

MyCryptpBank Ecosystem

MyCryptoBank will be the first bank for cryptocommunity, allows clients to receive and send funds in cryptocurrency and fiat money and also exchange between cryptocurrency and banknotes in the bank. With MyCryptoBank it will be possible to make deposits, receive loans and credit. The Bank will create infrastructure that will allow the establishment of purchases and traders for payment of goods for companies and online services. Clients will be able to accept bank cards and with that assistance they will take available funds through ATMs in the world and also pay at shops, restaurants etc. For client convenience, the bank plans to install crypto ATMs and ATMs, assisting in conducting operations on the purchase of cryptocurrency and cash receipts at a minimum cost. In the usual sense, it will be an ordinary bank with whole range of services but loyal to cryptocurrency and cryptocommunity. This will provide an undeniable advantage over other financial institutions, attracting many clients and their funds to create positive bank liquidity and enable supporting and developing all MyCryptoBank products.

MyCryptoBank’s main product

The Payment Ring is an analogy of a card without contact (touch), integrated into the bank’s payment system and allows to make payments similar to bank cards, to make payments simply by bringing the ring to the payment terminal and the amount needed to be deducted. You can also pay online online. Each payment ring has a set number, validity period and CVV code, the ring is durable and water resistant.

Multi Digital Cards are high quality cards for replacing ordinary plastic cards. They allow you to connect multiple cards at once: debit, credit, discounts, gift cards or even cards to fitness clubs. In other words they can connect to any card that has a default Barcode or EMV Chip, because Multi Digital Cards have the same size as traditional cards, you can use them for cash withdrawals.

Token

MCB Token is a central element of the MyCryptoBank segment, integrating all components of the financial ecosystem. All ecosystem tokens will be issued on ICO trips, without the possibility of additional emissions after ICO completion.

Advantages of MCB Tokens

MCB is a rapidly growing Cryptocurrency that allows to make payments, make money transfers directly and to the whole world.

MCB Tokens will be registered on the main Exchange Cryptocurrency

MCB Tokens allow using to be able to access all banking services

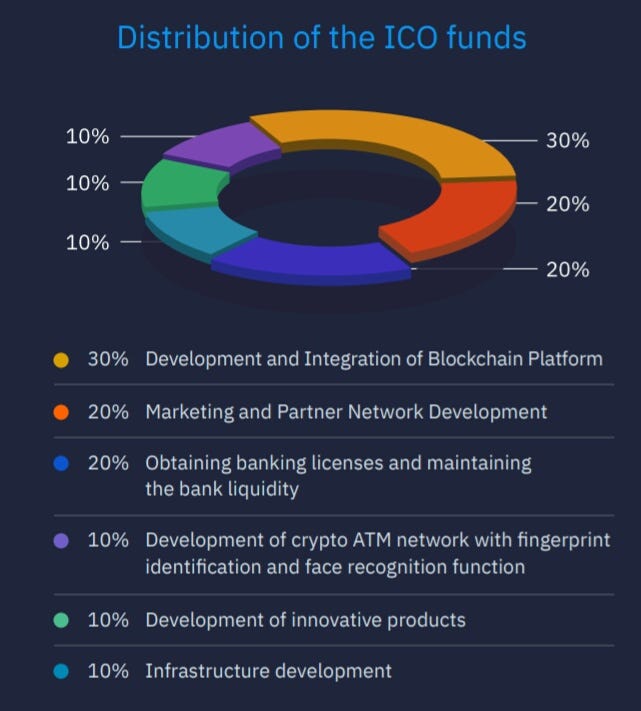

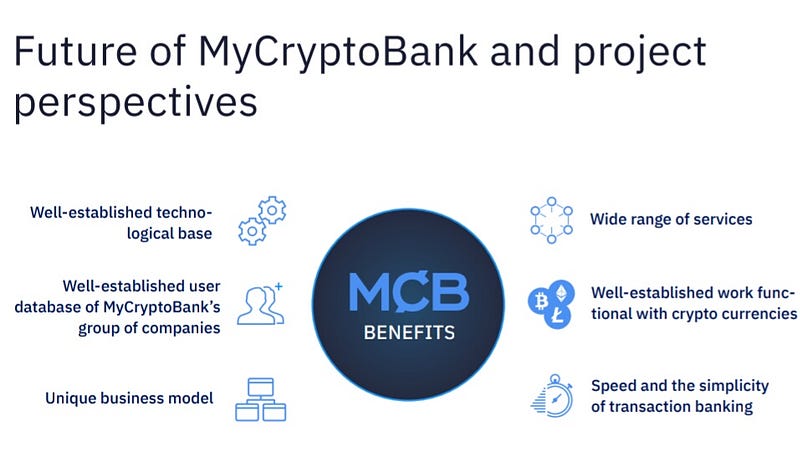

The perspective of the MyCryptoBank project is based on a combination of competitive project advantages and the current economic situation objectively from global financial markets. Interpenetration from FinTech’s market and traditional banking bring to market life for quality blockchain, including unique opportunities for MyCryptoBank. One of the most powerful and tangible advantages of this project is a well-established technology base, enabling the development of the most efficient projects, avoiding unchanging non-optimal solutions. Development of a by-stage project based on internal knowledge

Basis guarantees thorough thinking through every consequent step and careful allocation of investment assets, raised during ICO. With this, process cycle optimization is shorter time to complete the phase according to RoadMap.

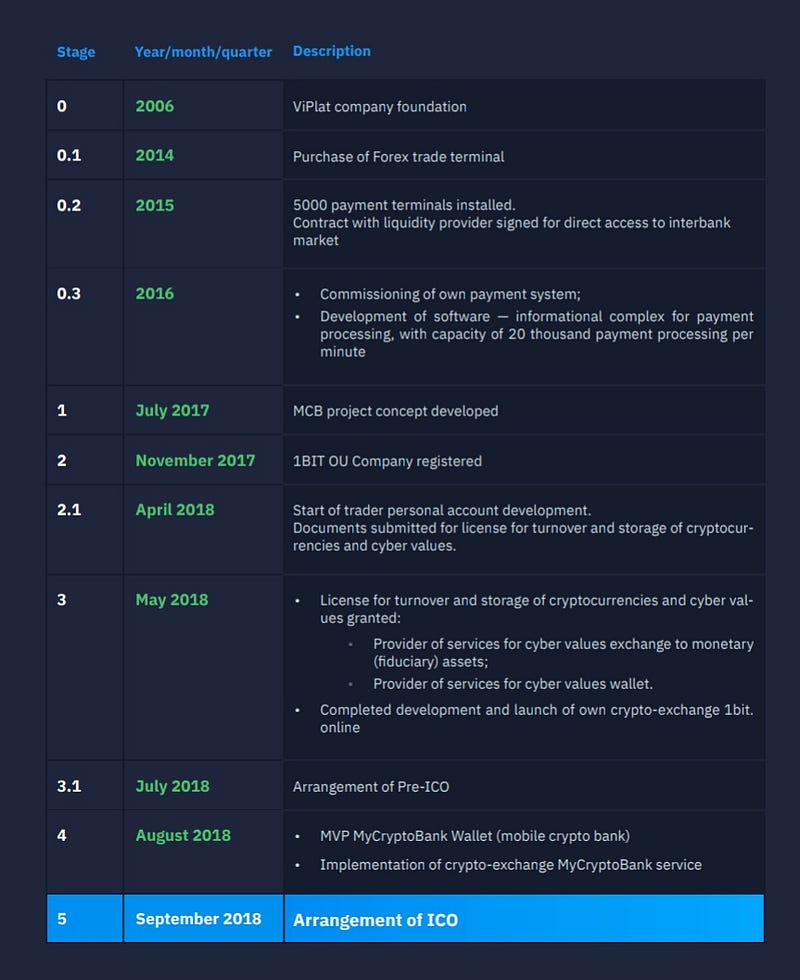

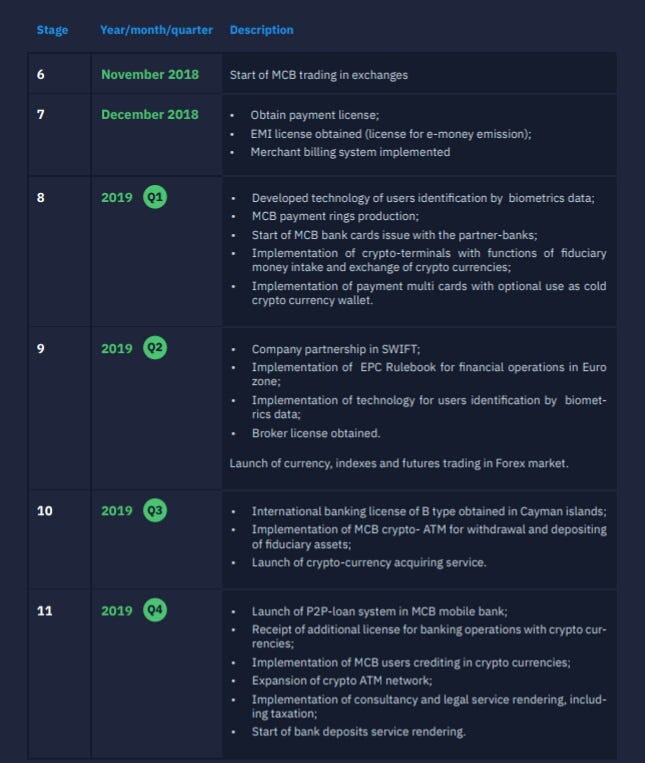

Roadmap

Implementation of MyCryptoBank (MCB) project comprises the below stages:

MyCryptoBank Team

Yuriy Bolshukhin

Co-Founder. Chief Operating Officer

A successful entrepreneur with more than 15 years of experience. An experienced business process manager. Average economic and higher technical education.

A successful leader, quickly responds to changes in the situation, independently makes effective decisions in a time of shortage of time, consistently and

purposefully achieves the goal, separating the main from the secondary. Worked in state structures. Successful experience of creating a new business. Communicative, responsible and purposeful.

Vladimir Bronnikov

Vladimir has over 20 years of banking experience. Since 1997, he has been working in the St. Petersburg branch of Bank Yugra, as deputy director, responding, inter alia, for automation and for the introduction of new technological solutions in the branch. In 2007 he was appointed director of the branch, which consisted of 16 branches in St. Petersburg and the North-

West region. He has extensive experience in developing economic planning systems and

monitoring the effectiveness of banking activities. Vladimir developed an interpolation model for planning and evaluating the performance of the branch,

which served as the basis for the development of such a system for the entire Bank. He was directly involved in the development of the Operating System for the MIR space station. Chief officer of the planning department.

Mohanraj Tamilarasu

Highly passionate professional in Cards and Payment Industry with a proven track record of 10+ Year experience in Product Strategy, Payment Application Development/Implementation and Business Analysis. Clearly focused on

unlocking innovation through new financial technologies, processes, and business models. Has been an instrumental in developing, managing, analysis, compliance and implementing acquiring and issuing solutions for close to 50+

Banks/Processors in India, Africa and GCC regi CPISI — Certified Payment Industry Security Implementer ( PCI DSS Version 3.2 ) ons.Director of cards and payments department.

Nikolay Panchenko

An experienced organizer of business projects at an early stage. Successful Forex and the Crypto trader with the experience of more than 10 years. Investor Fintech projects at an early stage. He is engaged in financial-strategic planning and control over the execution of assigned tasks. Has great skills in working with payment systems and merchant accounts. Has a higher education in management. Has good skills in negotiations with government agencies. Co-Founder. Chief Financial Officer.

Kyle Headley

Kyle has spent over a decade in the technology industry transforming the way businesses deliver services to their customers. After a successful career at British Telecom working with some of the worlds leading organisations Kyle

founded a new consultancy specialising in customer service improvement. Since then he has successfully worked with clients across the Private, Public, Charity

and Education sectors. Skilled in customer service leadership, continuous improvement, technology transformation, and IT service management. Kyle has

strong experience working within global technology environments and leading business enhancing customer service evolution. Blockchain enthusiast, ICO

Advisor and Spokes person.

Customer Service Strategy Director.

Anton Sivoded

Successful entrepreneur, Forex trader with more than 10 years experience. Has a higher economic education. Strong business development professional

focused in Business, Management, Marketing. Co-Founder. Chief Visionary Officer

John Luksic

An experienced investor, a specialist in marketing with experience more than 10 years. Investor relations expert

Maksim Markov

Founder and CEO one of the largest manufacturers of payment terminals, ATMs and other self-service systems in Russia. In 2007 graduated the University of Economics and Finance with a degree in commerce and marketing. Experienced investor, leader, innovator. A lot of successful projects have been implemented. Co-Founder. Chief business development officer

Bogdan Venglyuk

Banking professional with over 10 years industry experience. Have higher economic education in finance and credit. Worked in large regional banks to develop the client base of corporate and retail customers. Have a wide experience in the development of new banking products, risk management and business process optimization. Specialist in financial monitoring and compliance. Director of Operations Department

Davorin Bebek

An experienced campaign builder. Graduated with a Master’s Degree in Law from the University of Osijek, Croatia. Actively involved as social media manager and consultant for a number of companies in different industries.

Social Media expert

Jun Real

Jun is a marketing innovator in the USA for the past 17 years. He is instrumental in growing the membership of several organizations and significantly increase customer traffic and retention to various retailers around New York area. He played a key role in promoting various crypto currencies in the past years

and has extensive influence in the Filipino community with successful result. Jun also developed a revolutionary marketing platform called Pay Half Club which he intended to use to supplement the marketing strategy of My Crypto

Bank and generate huge number of MCB Token users. His plan is to launch the platform in various networks of community organizations, 33 branches

of Cristo Rey school networks and tap multiple participating stores by introducing the services of MCB to local chamber of commerce all over the mainland USA. Jun is confident that by incorporating Pay Half Club as a service or product of My

Crypto Bank, the move is going to bring the value of MCB Token ahead of it’s competitor in the global market and effectively deliver a significant change

to re-invent the modern banking system to the next level.

Chief Operating Officer for the Philippines

Anton Tokishin

Professional in information technology and cyber security with more than 5 years of experience. Provides cyber security for the nuclear power plant. Have higher technical education in IT. Experience in a large company providing technical support for users, support of infrastructure systems and provision of

information security services. Specialist in the field of automated information processing and management systems. Chief Information Security Officer

Alexander Dyupin

Innovative Event Planner with over 5 years industry experience, outstanding communications interpersonal and organisational skills! Adept at quickly accessed needs developing plans and implementing effective solutions that meet company needs in marketing and event coordination! Dedicated to exceptional

service and high perfomance in every talk! Specialization: negotiating and attracting investment. More than 15 successful events. IDACB — International decentralized association of cryptocurrency and blockchain. Director of communications with key clients

Dmitry Chernyak

IT consultant with more than 15 years experience of banking IT.

Designing and implementation of high reliability servers and IT infrastructure. Software development, including accounting systems, sites and mobile applications. IT consultant

Alexey Malikov

Experience in advertising and design for more than 15 years. Well versed in the behavior of people. Experience in sales 10+ years. He has extensive knowledge in the field of information technology. An innovator, a big proponent of progress. Sales Manager

Alexey Sidorowich

Alexey is Head of Sales and Marketing at B2B Software provider Merkeleon. With over 6 years experience in sales and financial apps development & launching

(eAuctions, eTendering, Crypto Exchanges), he provides the unique market expertise and innovative technical background for MyCryptoBank. Chief Product Officer

Benito Elisa

Benito has 12 years experience in the Banking sector of Mauritius as Private Banker for the High Net Worth segment. He has greatly contributed to the growth of the Banks’ portfolio of Affluent clients and has been providing investment advices for many years. Benito also spent two years as Advisor in

financial services for the Ministry of Financial Services and Good Governance of Mauritius. During the period March 2015 to February 2017 , Benito has been acting as Independent Director on the Board of a major Insurance company for

both Life and General sector. He was also entrusted by the Board of Director to act as Trustee for a Private Pool of pension funds managing billions of assets.

Benito graduated from the University of Technology, Mauritius in the Banking and International Finance field in 2010 and completed his Master of Business

Administration with specialisation in Financial services from the University of Mauritius. Being a Chartered Member of the Lions Club of a local branch [Lions

Club International], Benito has been fully engaged in Social works activities during the last 5 years and still strongly believes in voluntary works to help the needy. Chief professional consultant

Vladimir Nita

Vladimir has experience in the field of consulting and legal services for 9+ years. He has deep knowledge of legislation in the field of business organization, licensing, tax planning, accounting, opening bank accounts and document circulation in the territory of the European Union. For 8 years he has been the

head of Ruber Zeppelin OÜ.

Chief Compliance Officer

Naviin Kapoor

Blockchain & ICO expert, and a business transformation leader with more than eleven and half years of experience in project management and business analysis and more than one year of experience in Ethereum, Bitcoin, Hyper

ledger, EOS, consensus protocol and distributed/shared ledger technology. He has also attained various industry certifications such as PMP, CBAP, ITIL & CSM. He had worked on various banking transformation projects –“sustainable and disruption”, which were initiated in various domains such as Retail Banking, Cash Management, Integrated Liquidity Management (ILM), Corporate Banking, Asset

& Wealth Management, Financial Messaging, Regulatory Sanctions Filtering and Local and International Payment Systems.

Blockchain ICO expert.

Alexander Frolov

Has a mathematical and analytical mind. Graduated Moscow Institute of Engineering and Physics, dep. Cybernetic. Serial entrepreneur. 10+ years experience in marketing in FMCG (L’Oreal, Procter and

Gamble, Philip Morris., Groupe Seb (Tefal, Krups, etc)). Head of PR department

Bounty Campaign

Signature Campaign : 25%

Video Campaign : 15%

Article Campaign : 15%

Twitter Campaign : 15%

Facebook Campaign : 15%

Translate Campaign : 15%

For More Information you can follow the link bellow :

WEBSITE | WHITEPAPER | TWITTER | FACEBOOK | TELEGRAM | REDDIT | LINKEDIN | INSTAGRAM | MEDIUM | YOUTUBE

Username : bandaro

Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1167442